Manual invoicing was a major problem for me as a creative photographer. I needed a solution that would automate the process, help me get paid faster, and free up my time to focus on what I enjoy doing. I was looking for an invoicing program that was user-friendly and didn't require any technical expertise.

The accounting and invoicing software for small business can make a huge difference in your work. It simplifies recurring invoicing and generating payment reminders, and helps you get paid faster. Plus, with such a tool at hand, you can keep everything organized in one place and focus on your business, not your paperwork.

| Software | Main Features | OS | Free Version |

|---|---|---|---|

|

Customizable templates, brand integration |

Web, Android, iOS |

✔️ |

|

|

Detailed reports, time tracking feature |

Web, Android, iOS

|

✔️ |

|

|

Automatically tracks invoices, ensures accuracy |

Web, Android, iOS

|

❌ |

|

|

Simple interface, secure payments |

Web, Android, iOS |

❌ |

|

|

Preview, good reporting and search capabilities

|

Web, Android, iOS |

✔️ |

|

|

Basic accounting, financial reporting |

Web, Android, iOS |

❌ |

|

|

Notifications for due payments

|

Web, Android, iOS

|

✔️ |

|

|

For handling billing for multiple companies |

Web, Android, iOS

|

✔️ |

|

|

Time tracking, invoicing, expense tracking, project management

|

Web, Android, iOS

|

✔️ |

|

|

All major cards accepted, unlimited number of users |

Web, Android, iOS

|

✔️ |

|

|

Invoice reminders, auto-billing and recurring invoices |

Web, Android, iOS |

✔️ |

|

|

Great templates, useful reports |

Web, Android, iOS |

✔️ |

Ease of use and rich functionality were top priorities for me when I was selecting inventory and invoice software. I needed a tool that could handle invoicing, payment tracking, and the creation of automated reminders, without being overly complex.

Other important factors were customization, payment integration, and affordability. I wanted to create invoices that matched my brand, so a program should support photography invoice templates. Besides, I wanted to make it easy for clients to pay online. All of the options I considered offered a free plan or free trial.

★★★★★ (5/5) – Professional quality invoices

Price: Free (basic editing tools and limited assets) or from $9.99

Compatibility: Web, Android, iOS

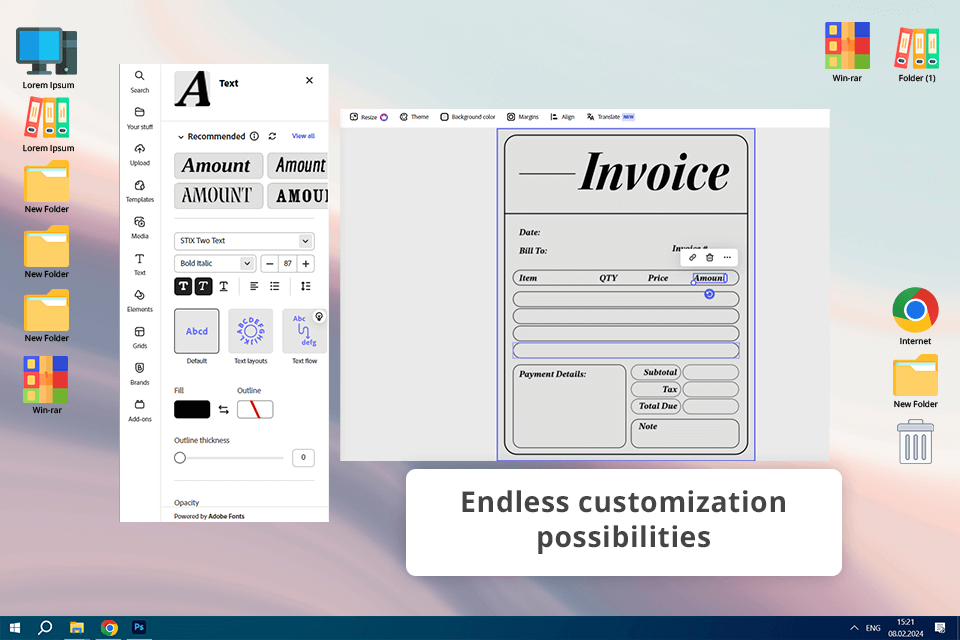

While primarily known for its design capabilities, Adobe Express offers a surprisingly effective solution for small businesses seeking pro-quality invoices. It has a user-friendly interface and you can easily drag and drop elements to create invoices that fully align with your brand. Busy entrepreneurs will definitely appreciate the possibility to access and edit invoices from any device.

One of the bragging features of Adobe Express is its customizable templates. It is possible to tailor them to match any logo, color, and unique brand identity. What's more, I was able to customize service descriptions, hourly rates, or package details, so my invoices would accurately reflect my business offerings.

Adobe Express simplifies the process of exporting invoices as PDFs or sharing them directly with clients. After a recent family portrait session, I was able to create a detailed invoice with itemized charges and my brand information in just a few minutes. As a loyal Adobe software, I quickly mastered Express and integrated it into my workflow.

★★★★☆ (4.5/5) – Invoice sending & tracking

Price: Free

Compatibility: Web, Android, iOS

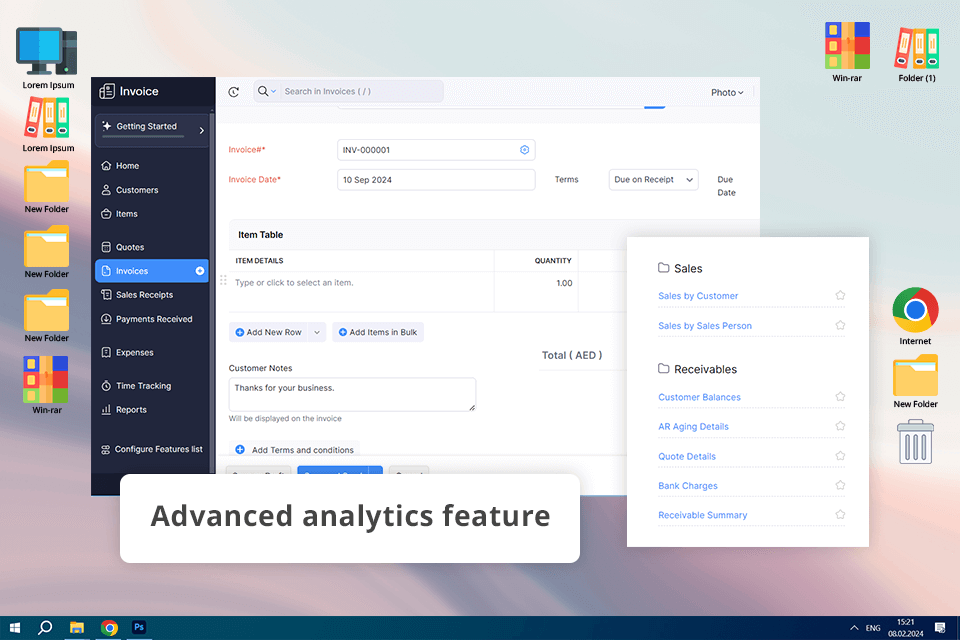

Zoho Invoice is top-notch billing and invoicing software for small businesses. It offers a range of useful features, including customizable templates to create professional invoices, automatic reminders to follow up on overdue payments, and in-depth reports to track your business's financial health. One of my favorite options is its time-tracking tool. With it, I can log my billable hours for editing and shooting projects and convert them into invoices quickly.

Zoho Invoice offers valuable insights into my business's finances. I can keep tabs on my savings, client response times, invoice volume, and payment returns. Plus, it integrates with popular payment gateways like PayPal and Stripe. If you use other Zoho tools like CRM, Analytics, or Books, you'll appreciate how well they work together.

I frequently use this website to create and download free invoice templates. I took advantage of their free templates to create a detailed invoice that clearly outlined the costs for the shoot, editing, and travel. I set up a reminder to follow up on the payment. Clients were able to transfer costs hassle-free thanks to the integrated payment options.

★★★★☆ (4/5) – Automated recurring invoices

Price: 30-day free trial, then from $17.50/mo

Compatibility: Web, Android, iOS

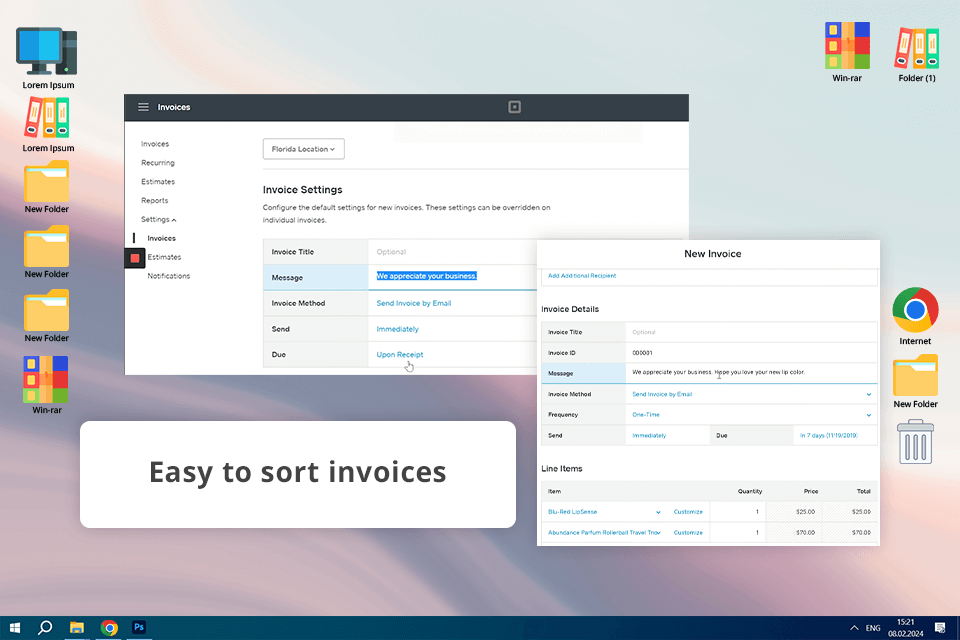

QuickBooks is ideal for all kinds of invoicing, from basic accounting transactions to complex contract review tasks. This invoicing software comes completely built into the accounting program, so I don't even have to install it on my computer.

Also, small businesses can set up a tab for invoices, with QuickBooks, or they can print custom invoices with their specific information.

Even though I'm not an accounting expert, mastering QuickBooks was easy thanks to its user-friendly. I was able to customize the invoices with my branding, adjust the layout, and include all the important details for my clients. There are also terrific automatic payment reminders and late fees, so I can be sure I’ll get my money.

QuickBooks offers a variety of payment options, so clients can pay directly through the invoice. They can use credit cards, ACH transfers, PayPal, or Apple Pay. Besides, this invoice app helps me keep track of my business expenses, including photography equipment, travel costs, and software subscriptions.

★★★★☆ (4/5) – With a bookkeeping feature

Price: 30-day free trial or from $5.70/mo

Compatibility: Web, iOS or Android

FreshBooks makes it a breeze to create professional invoices. I love how it automatically adds my tracked time and expenses, calculates taxes, and lets me customize payment options. Plus, getting notified when clients view or miss an invoice is super helpful. I also appreciate the integration with Shopify and Zoom.

This invoice software for Mac automatically processes bills and pays them as they are due. I do not have to manually input any data, and I do not have to worry about errors because the invoicing software automatically corrects them. The program accepts online credit cards, Stripe and PayPal payments, and even allows for ACH transfers for a small fee.

★★★★☆ (4/5) – Preview of invoices

Price: Free (no batch invoicing) or $30/mo

Compatibility: Web, Android, iOS

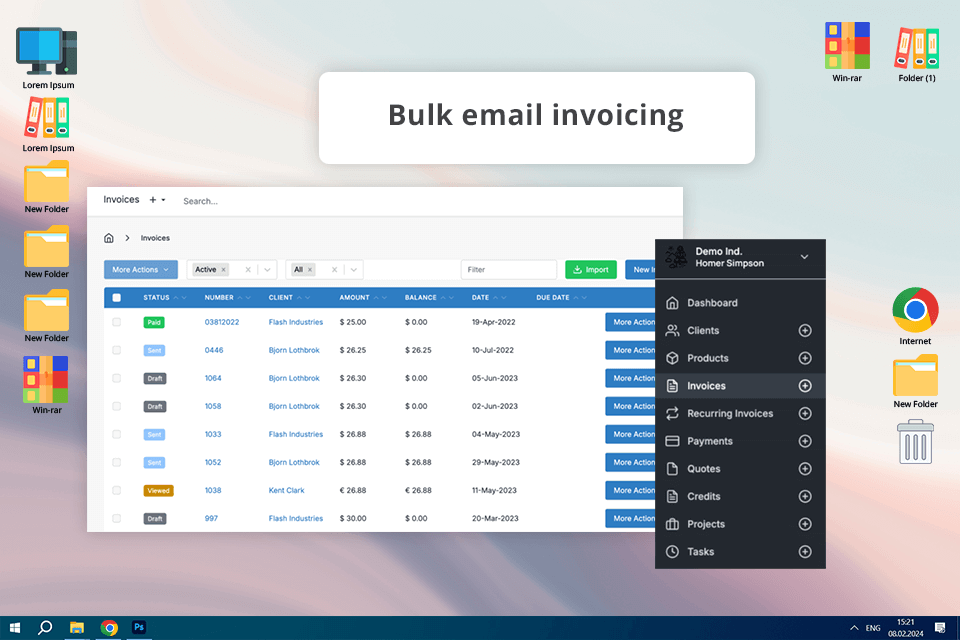

The Square Invoices is an easy-to-use small business software for invoicing. It has many advanced features such as invoice printing, tracking of expenses and recurring charges, automatic data printing, and more. I save time with automatic bill sending and tracking.

Small businesses can choose which date they want to send their bills, you can also opt to do it automatically or manually. I can set up reminders for each bill so I know exactly when to mail them out. It’s also possible to send out statements via email. If I need to print customer checks, though, I’ll need to use third-party check printing software.

★★★★☆ (4/5) – Bulk import invoices

Price: 30-day free trial or from $7.25/mo

Compatibility: Web, Android, iOS

What is the best invoicing software for small business in terms of flexibility? Xero can be a good contender for the title. You can easily customize your invoices with your company logo, choose your preferred colors, and add any specific information.

This accounting software for medium sized business also helps you automate your invoicing process by sending automatic payment reminders and allowing customers to pay directly using ACH transfers, Google Pay, Apple Pay, or credit cards.

Xero is a wonderful choice for businesses with international clients. It automatically handles payments in different currencies, giving you accurate exchange rates. Plus, with its automated reminders and recurring invoice features, you can save your time on administrative tasks. So, if you also strive to streamline your invoicing process, opt for this tool.

★★★★☆ (4/5) – Variety of invoice types

Price: Free or from $9.99

Compatibility: Web, Android, iOS

By managing the small photography business, it means finding efficient invoicing software, and in that regard, Vantazo is a good enough option. One of the features which really drew my attention was easy payment tracking. This will ensure that tracking money matters is less cumbersome and better integrated into daily activities.

Furthermore, Vantazo offers various types of invoices for specific service requirements. This is the kind of adaptability it can do-whether it's a simple service invoice or detailed freelance billing.

★★★★☆ (4/5) – For multi-company billing

Price: Free or from $5.47/mo

Compatibility: Web, iOS and Android

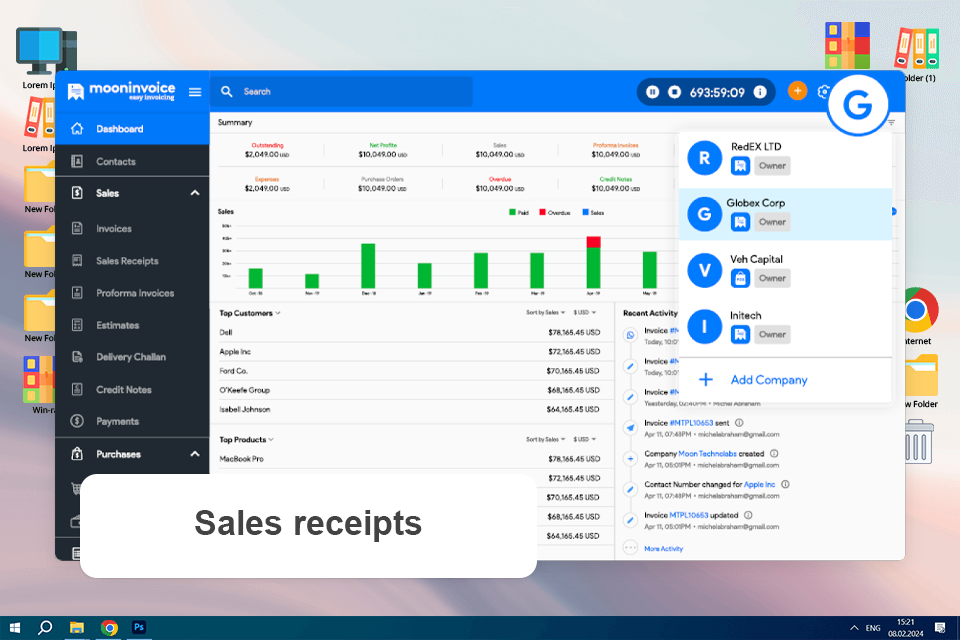

At a time when MoonInvoice is fast making it really easy in invoicing and managing money, it has more than 66 customized templates by its side to easily personalize and invent my different bills and estimates. Be that from a design point of view, every single content is so comprehensible on customizations.

I used and much enjoy the auto-pilot modes - automatic invoice creation and which help me get paid as and when due without genuinely the need for creating an actual invoice. It also contains 15 different templates for reports, which have helped me a lot in terms of tracking my expenses and financial information.

★★★★☆ (4.5/5) – Online payment support

Price: Free or $5.9/mo

Compatibility: Web, Android, iOS

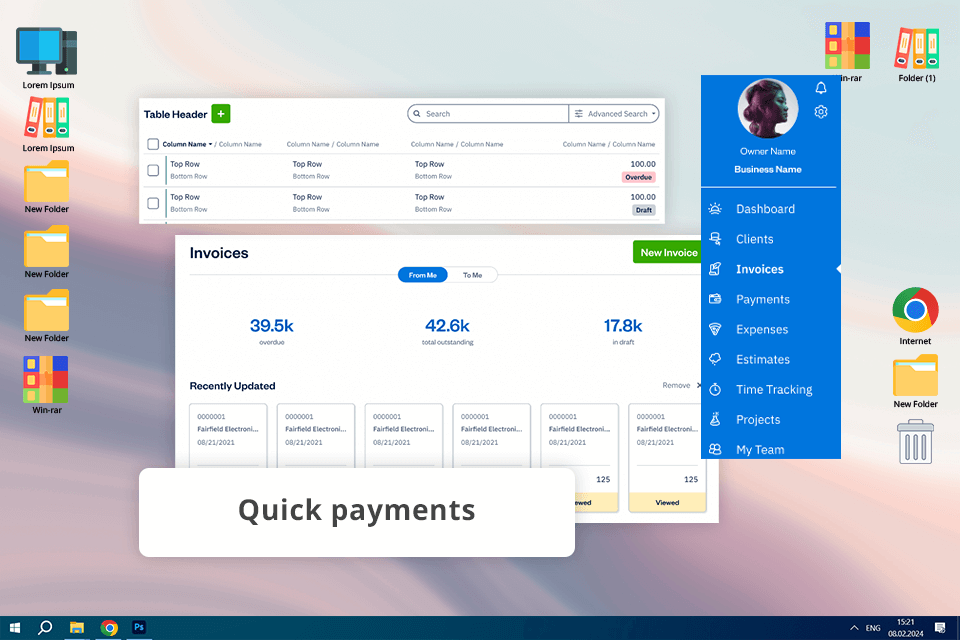

Paymo simplifies creating professional invoices and sending them to customers in just two clicks. I use it to convert tracked hours into comprehensive invoices without having to begin from scratch every single time.

It allows me to better manage my estimates and track costs more effectively. I can create estimates from project plans, make them into invoices when authorized, and categorize all costs by client or category. Everything is housed in one area, making accounting so much simpler.

Repeating billing and online payments are particularly handy. I set the repeat schedule and the software automatically sends out the bill and changes the status once paid. This is saving me time and allowing me to concentrate on client work rather than payment chasing.

★★★★☆ (4/5) – Instant notification

Price: Free or from $16/mo

Compatibility: Web, iOS and Android

If you're a freelancer, solopreneur, or small business owner looking for a simple way to manage your finances and invoices, Wave is the perfect solution. Designed with user-friendliness in mind, it simplifies the process of creating and sending professional invoices. This platform is ideal for businesses that primarily receive payments through invoices.

Bill consolidation is another feature included with this invoicing software. It allows me to consolidate all my invoices into one invoice and use it to pay all my bills. Wave also makes it easy to accept online payments by credit card or bank transfer. In addition to invoicing, it provides tools for tracking expenses and generating financial reports.

★★★★☆ (4/5) – Expense tracking

Price: Free (4 templates) or from $120/year

Compatibility: Web, iOS and Android

Invoice Ninja is top invoicing software for small business. You can easily customize your invoices to match your brand, insert your recognizable logo, adjust the layout, and more. Plus, there is a dedicated client portal.

With it, your customers can view their invoices, payment history, and make payments online. If you need to track income, manage expenses, or get a clear picture of your business's financial health, leverage the reporting tools available in the software.

Invoice Ninja gives you total control over your invoicing. You can easily collect deposits, set minimum payment requirements, and add taxes or tips. Plus, your clients can pay online using their favorite methods be it credit cards, PayPal, or even bank transfers. If you choose paid plans, you'll get even more powerful features, e.g., bulk invoicing.

★★★★☆ (4/5) – Send unlimited invoices

Price: Free (up to 5 invoices/mo.) or from $9.99/mo.

Compatibility: Web, iOS and Android

This invoicing software is a must-have item for any small business that wants to keep accurate records of sales and billing transactions. Invoicely allows users to print out checks, receipts, and invoices. It has templates for different invoicing operations. Fill free to add your logo, use your brand colors, and create professional invoices that reflect your company's identity.

One of my favorite features is the possibility to generate and send account statements. These statements provide a detailed overview of all past transactions, making it simple to track my business's financial interactions. I also appreciate the option to send automatic payment reminders, so I can have a steady cash flow.

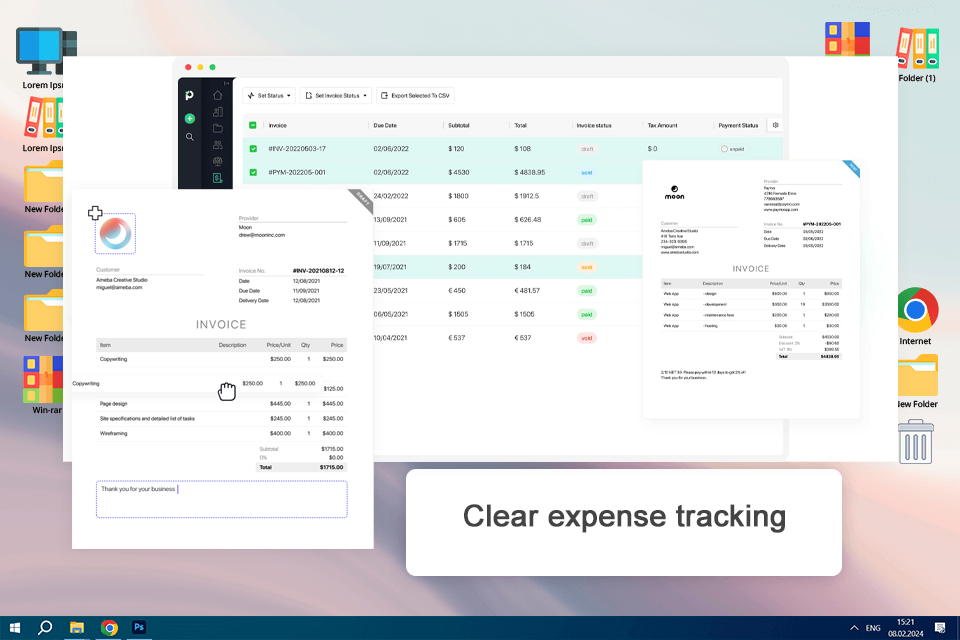

To create professional and informative invoices, make sure to include your company and contact details, customer billing information, clear payment instructions, a detailed list of items or services, and accurate pricing. Depending on your specific business needs, you may also want to add sections for quantity, tax, hours worked, or shipping costs. By adding branding elements, you will receive a professional and unique invoice.

The most common method is to download the invoice as a PDF file from your invoicing software and then email it to your client. If you favor a more traditional approach, you can also print the invoice and send it through the mail.

Generally, it is. To ensure the security of your transactions, check whether your payment gateway is PCI compliant. This means it adheres to strict data security standards set by industry experts, protecting your customers' sensitive information.

Many users claim Adobe Express matches this description. It has an intuitive interface, a quick setup process, and straightforward features.

Absolutely. Many popular invoicing software have mobile apps available for both iOS and Android devices. This means you can create and send invoices, track payments, and manage your clients from anywhere. Some popular options optimized for mobile use are Adobe Express, Zoho Invoice, FreshBooks, Square Invoices, and Wave.

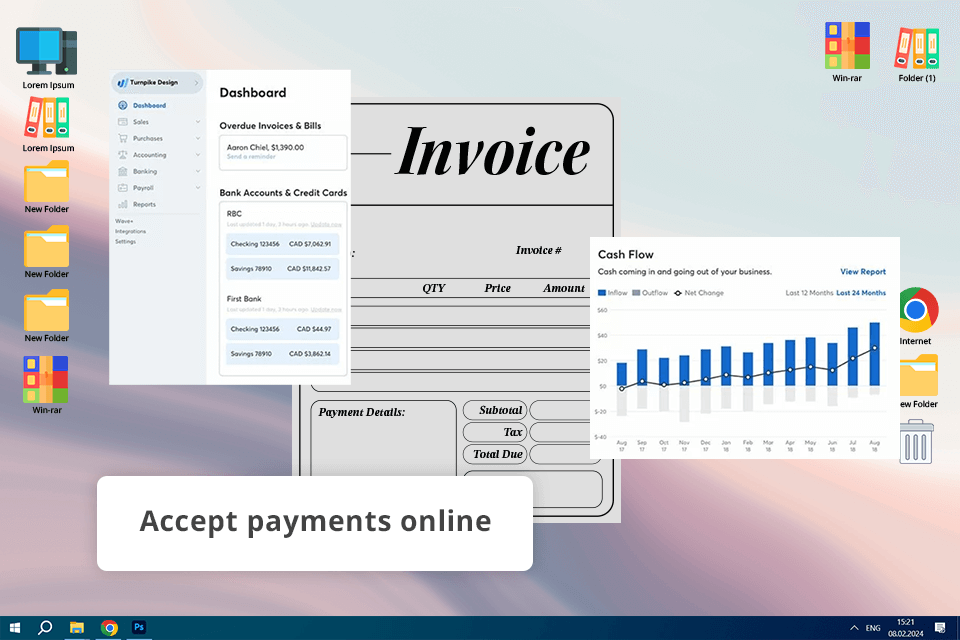

Many invoice programs go beyond just creating invoices. They can help you manage your finances by tracking expenses, monitoring cash flow, and generating reports that are essential for tax preparation. Some popular options, like Xero and FreshBooks, offer comprehensive accounting features, while others, such as Wave, provide more basic but still helpful tools.

Most reliable invoice software providers, like Zoho Invoice, QuickBooks Online, and FreshBooks, use advanced encryption and security measures to protect your business and customer information. Look for software that offers two-factor authentication and adheres to industry-standard security practices to ensure your data is always safe.