If you run a business and want to keep your accounting stuff in order, then getting the best accounting software for medium sized business is a really smart choice. There are numerous programs that you can use for the task, but make sure to get the most efficient one to control your financial state successfully.

The best accounting software for medium sized business comes with many cool features – timely reporting and insight, organizational tools, automatic functions, co-op options, multiple integrations, and strong security. Besides, all these goodies are available at a very moderate cost.

I have selected several accounting programs evaluating their features, accounting capabilities, pricing and user-friendly interface. Other important criteria were the availability of customer support, integrations, security level and general compliance with today’s demands.

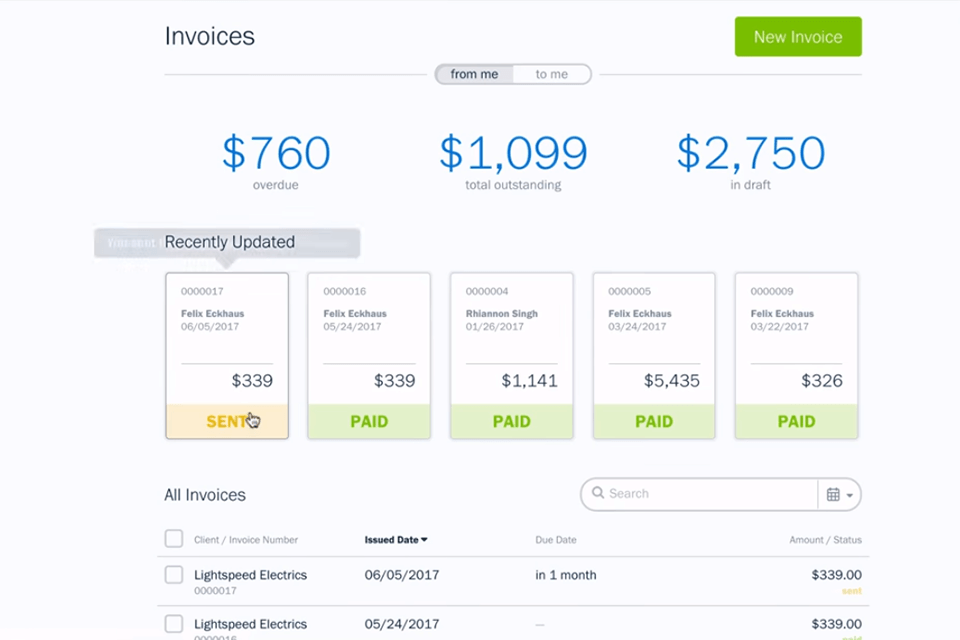

Verdict: FreshBooks accounting software for medium sized business is suitable for almost any type of business. The various features include detailed customer financial statements, real-time gross sales reports, and online or offline customer order tracking.

You can set up a separate department to monitor and control accounts receivables, while your accountants can focus on those accounts that require closer attention.

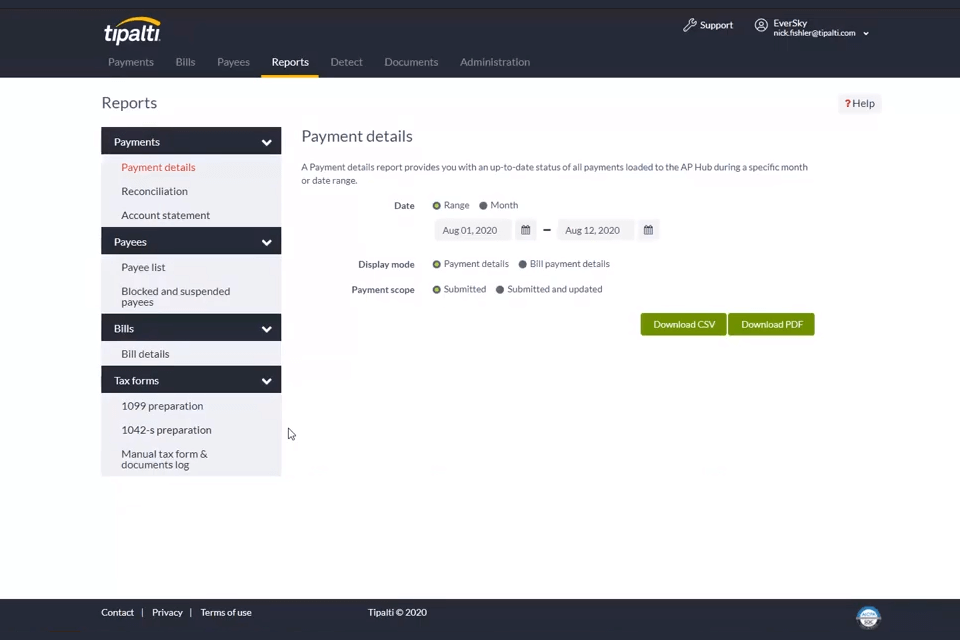

Verdict: This software is capable of handling all the financials of your business very easily. It is designed in such a way that it can handle, maintain, track and graph your business finances very easily. This software is also very easy to operate and understand.

The features of this software include invoicing, expense report generation, multiple user profile, payable orders, expense tracking, budgeting, customer invoice processing, asset grouping, workflow and manual tasks among many other features.

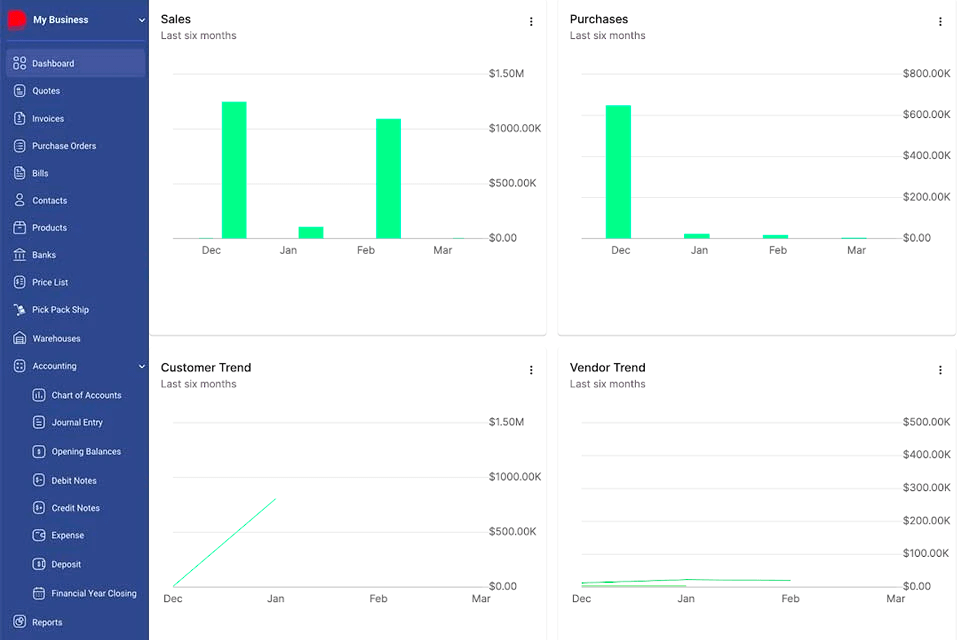

Verdict: Deskera ERP offers a clear accounting option for small and medium-sized business holders, bookkeepers, and accountants. It allows businesses to take full control of their chart of accounts.

The prior account types in Deskera ERP involve Assets, Liabilities, Equity, Revenue, and Expense. Customers may choose from the list of default Chart of Accounts available in Deskera’s accounting option.

Furthermore, the platform offers a plain double-entry accounting that simplifies the tracking of each business transaction within the organization.

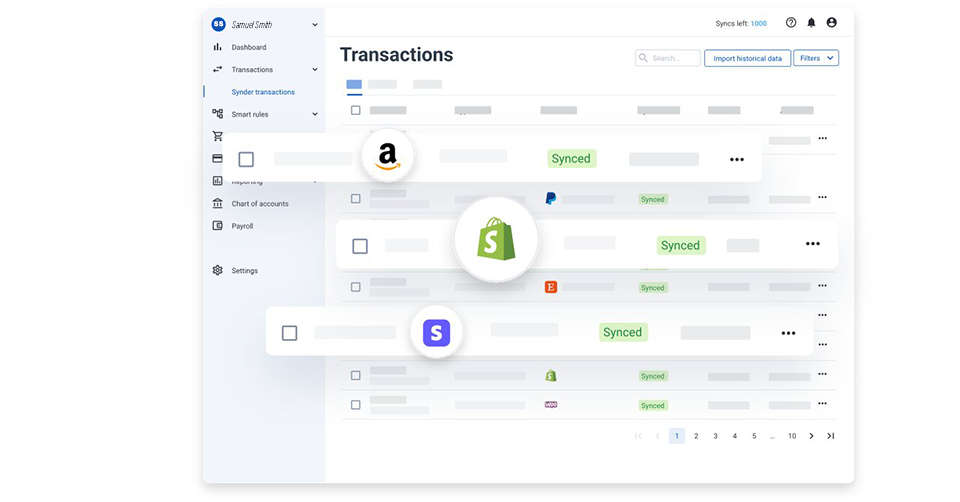

Verdict: Synder, undoubtedly, stands out as one of the finest accounting software solutions for medium-sized businesses. This versatile platform seamlessly synchronizes your online sales channels, ensuring that your financial data is not just reconciled but also meticulously organized with remarkable ease.

What makes Synder exceptional is its comprehensive data synchronization capabilities, offering users the flexibility to choose between daily summaries and per-transaction modes across 25+ integrations, all at no additional cost. This means your data is always handled at the level of detail that suits your business.

The benefits of Synder extend beyond data synchronization. With this software, you gain access to instant analytics and reporting, including automatically generated P&L, Balance Sheets, cash flow reports, and best sellers across all your online channels. These reports are tailored to meet your specific needs, simplifying your financial analysis.

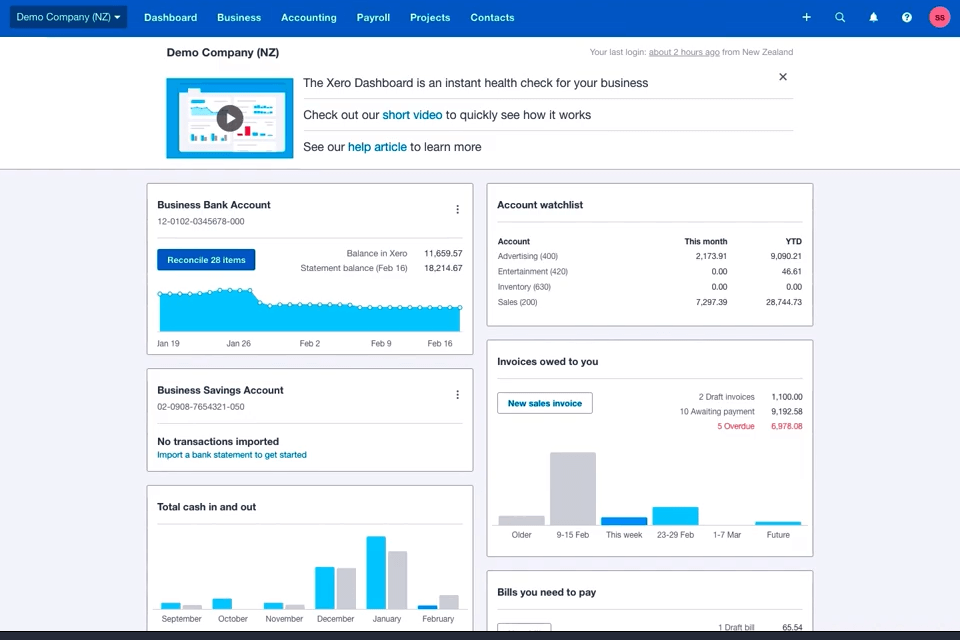

Verdict: Xero accounting software for medium-sized businesses is an excellent solution that can greatly help you in maintaining accurate financial records. This accounting program will not only make your accounting tasks much easier but it will also help you save up on a lot of time as well as provide you with accurate financial data that you need in order to conduct your business properly.

This payroll software is capable of keeping track of all of your expenses, sales, income and other financial transactions and will also automatically integrate with your sales force so that they will be able to report to you at any time. This means that you would have accurate and complete information about your business every single month.

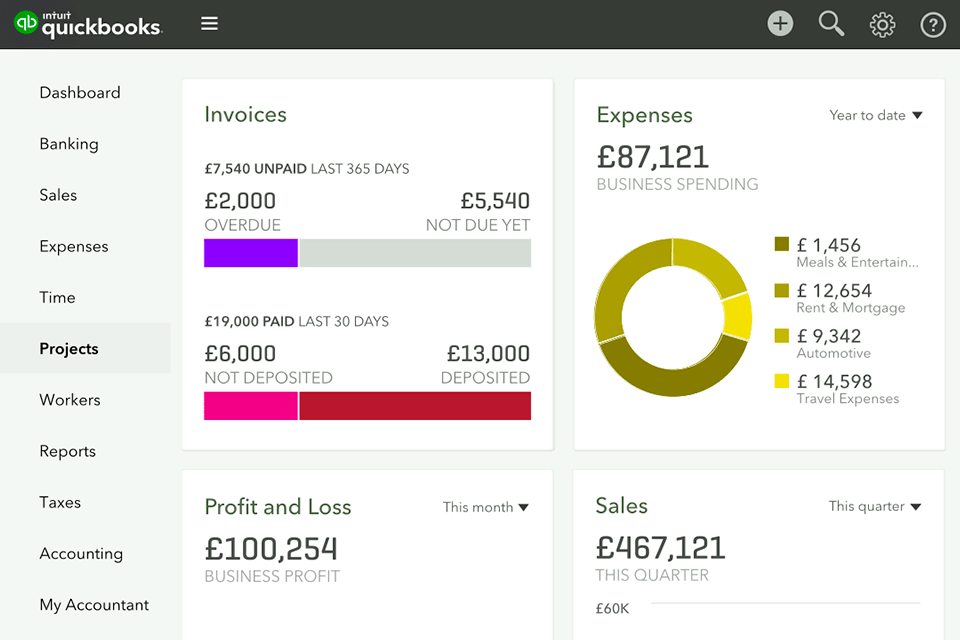

Verdict: QuickBooks accounting software for medium-sized businesses is designed to make the everyday task of accounting a little easier, especially for small to medium size businesses. You can utilize QuickBooks online from your own computer and can print your checks right from your computer as well.

QuickBooks provides a robust software solution for handling financial transactions in an efficient manner. If you are running a retail business, then using QuickBooks will help you manage your business accounts receivables, payables, and payroll more efficiently. QuickBooks offers comprehensive features and tools such as invoicing, sales, print reports, and balance and payment management. QuickBooks provides excellent financial tools and a wide range of software options that enable you to manage your finances better.

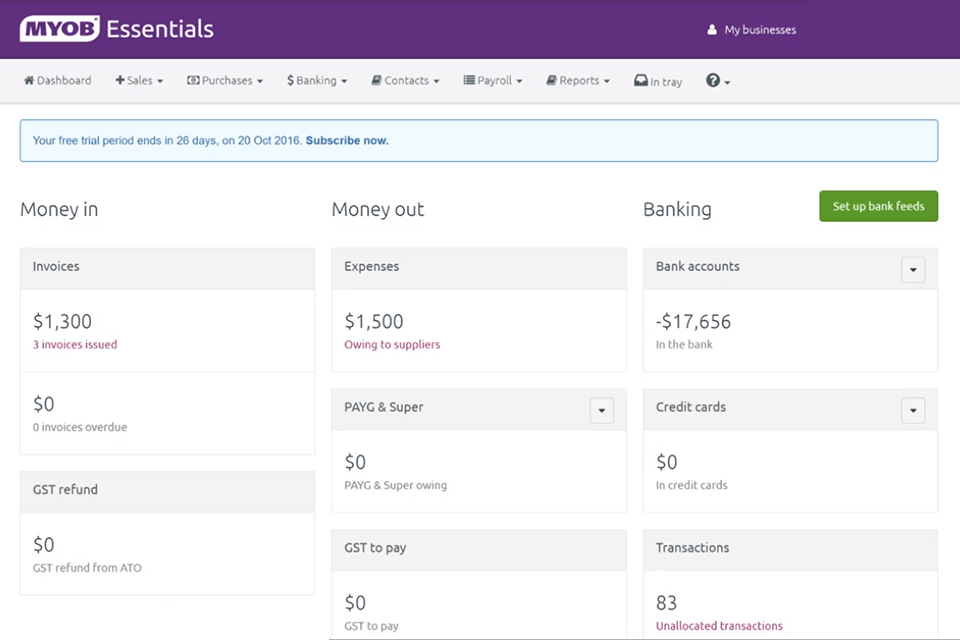

Verdict: MYOB Essentials accounting software for medium-sized businesses has everything that a growing business needs in order to grow and be successful. The first thing that the software will do is to manage the company's finances, taking care of every penny from payroll to stock purchases and all expenses including travel and entertainment.

The next thing it will do is to create and maintain work groups, work plans and paychecks for each employee in the company. The last thing it will do is to keep an eye on the company's sales and accounts.

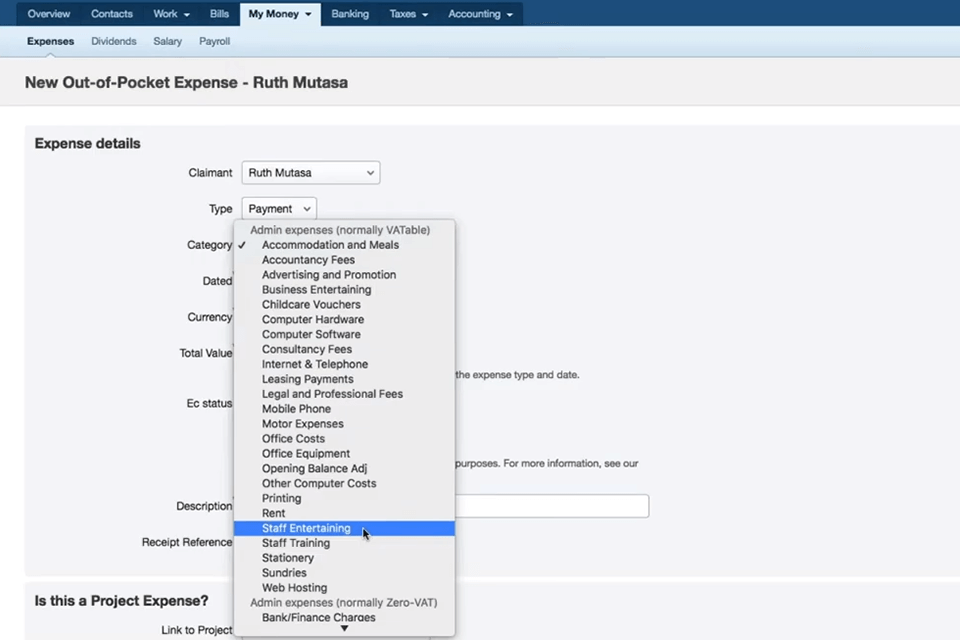

Verdict: FreeAgent accounting software for medium-sized businesses is a perfect solution to your needs. FreeAgent offers complete accounting solutions and has been developed by the award winning PwC company FreeAgent.

You can create, customize and manage your own accounting data, and can handle all financial transactions such as billing, payments, tax and invoice processing with great ease and simplicity. FreeAgent is a user-friendly web-based software that you can install on any operating system that you wish.

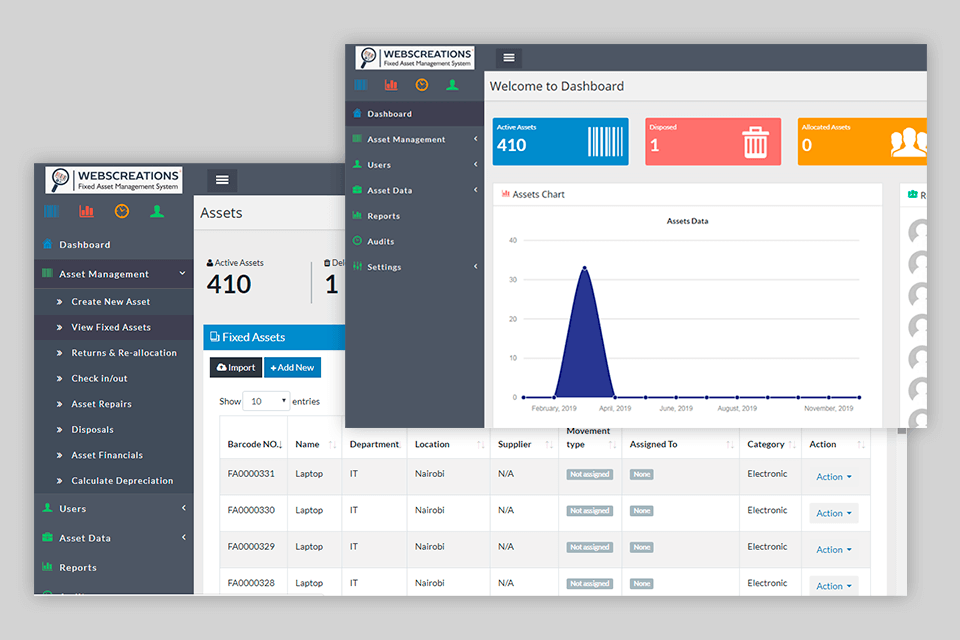

Verdict: AsseTrack is a great choice if you want to build an automated system to track and record your funds. You will receive automatic dynamic reports, which makes accounting and maintenance of assets so much easier. The program tracks all your assets in real-time, which helps reduce administrative costs.

AsseTrack FAMS also has tracking features that ensure a thorough inventory using a simple, step-by-step graphical process. Another important peculiarity is advanced built-in data protection.

Verdict: Refrens accounting software for medium sized businesses is a reliable solution built to simplify day to day financial operations. It helps you manage invoicing, payments, expenses and accounting with clarity while keeping all data organized in one place.

One of its biggest advantages is AI Freya, which automatically analyses your financial data and provides quick insights, trends and suggestions to help you understand performance better. Along with this, the platform offers GST compliant invoicing, automated reminders, real time reports and multi user access for smooth collaboration.

Refrens also supports integrations and ensures strong data security, making it a dependable option for businesses that want to streamline their financial records and maintain accurate books with minimal effort.