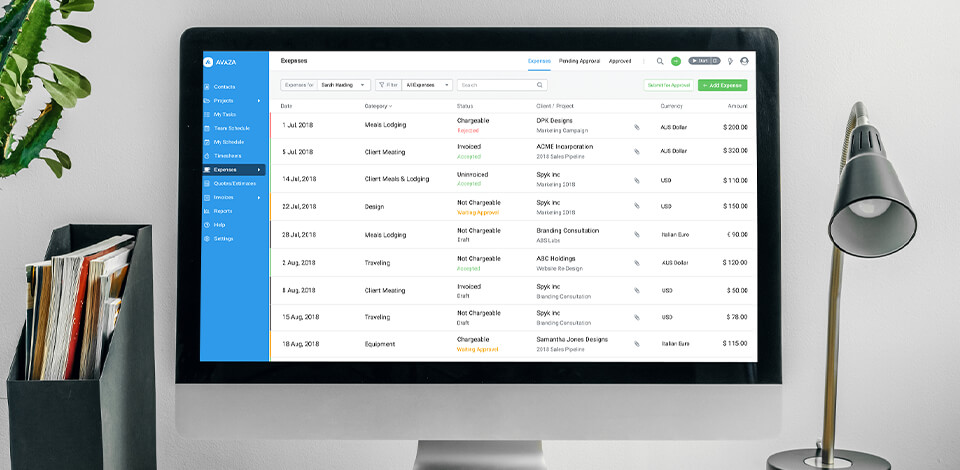

The best spend management software can help you automatically track expenditures and receive a clear overview of overall expense trends. The list of offered options covers everything from basic receipt scanners to credit facilities integrated with accounting software.

Spend management platforms are ordinarily represented by cloud-based solutions used for tracking, managing, and optimizing all business expenditures.

There’s a solid range of quality expense management solutions that you can start leveraging today. The premium options will typically cost you between $15 per user/month to $549/annually. Alternatively, you can check out some of the free tools that offer a comparatively impressive feature set.

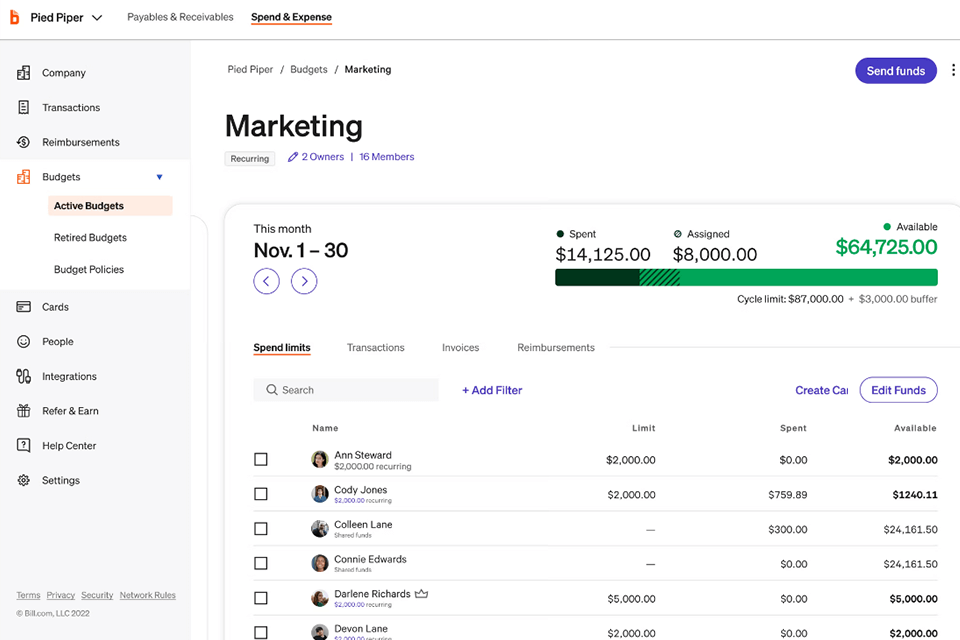

Verdict: BILL Spend & Expense (originally marketed as Divvy) is a full-cycle spend management software that offers corporate cards as well as real-time monitoring of your company’s expenditures. By combining a convenient platform with a special card, this tool allows enterprises to optimize their financial processes.

The provided functionality covers automated expense reports, budget breakdowns, and reimbursement processing, meaning you’ll no longer have to reconcile card statements manually. Thanks to the constantly updated reports on staff spending, this platform enables companies to improve their budget management and abandon the inferior “spend now, say sorry later” approach.

Despite offering a large number of useful features, this platform is completely free for any number of users.

Verdict: This business spend management software has split its system into four main modules: Start, Scale, Streamline, and Save. Each module offers a different set of features.

The Start category provides access to features that allow you to handle multiple cards, bill payments, and expense accounting. The Scale section allows you to implement your corporate policies related to expenditures. The Streamline module offers multiple workflows for managing expenses and integrating Ramp with other business tools.

Another noteworthy feature is the provided real-time tracking of employee expenses, which notifies you every time a suspicious activity has been detected as well as informing you about cashback purchases, partner rewards, and zero-fee foreign transactions.

The main feature set of this software is available for free, but if you’d like to expand the offered functionality, you can pay $15 a month per user.

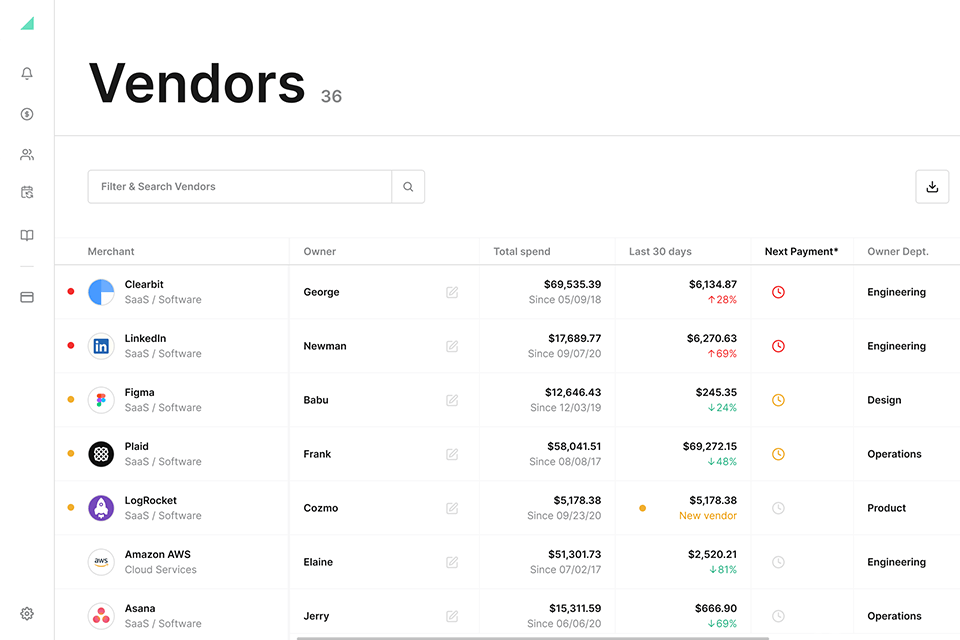

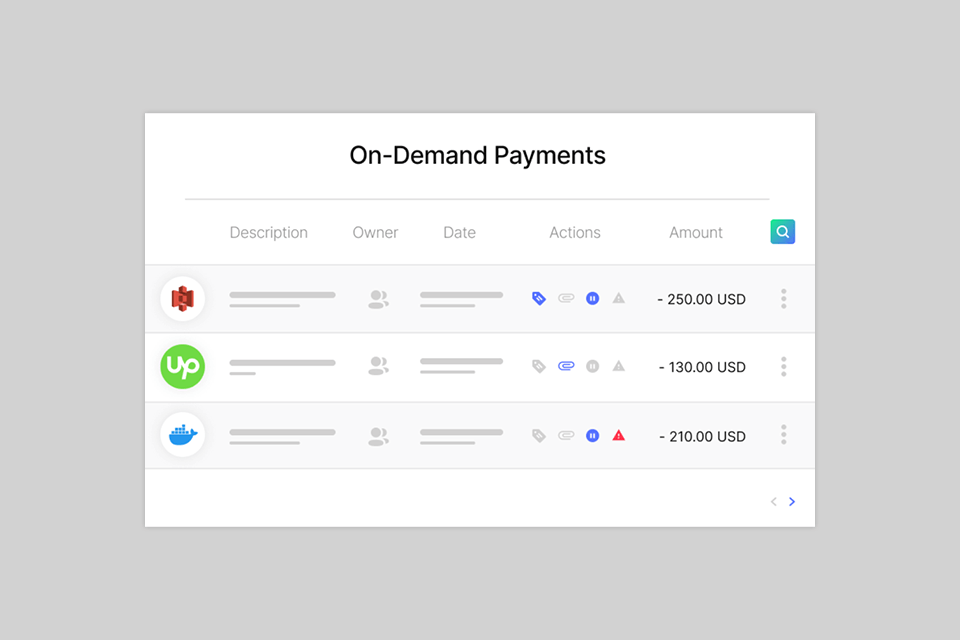

Verdict: One of the key features of Mesh Payments is called Spend Insights. Every time you examine an expense item, the provided mobile application will automatically display future saving opportunities, current rate expense forecasting, and much more.

The Spend Controls toolkit provides real-time expense request notifications, allows you to set expense limits, unsubscribe from various services within a single UI, and block vendor payments in just one tap. This software enables you to create digital and physical cards with preset budgets, assign cards to specific vendors, and delete cards whenever such a need arises.

Additionally, Mesh Payments fully automates the grouping of expenses, receipts, payments, and various processes related to invoicing software while also offering convenient purchase monitoring.

This platform is completely free. Moreover, the company offers various bonuses for using their Mesh cards.

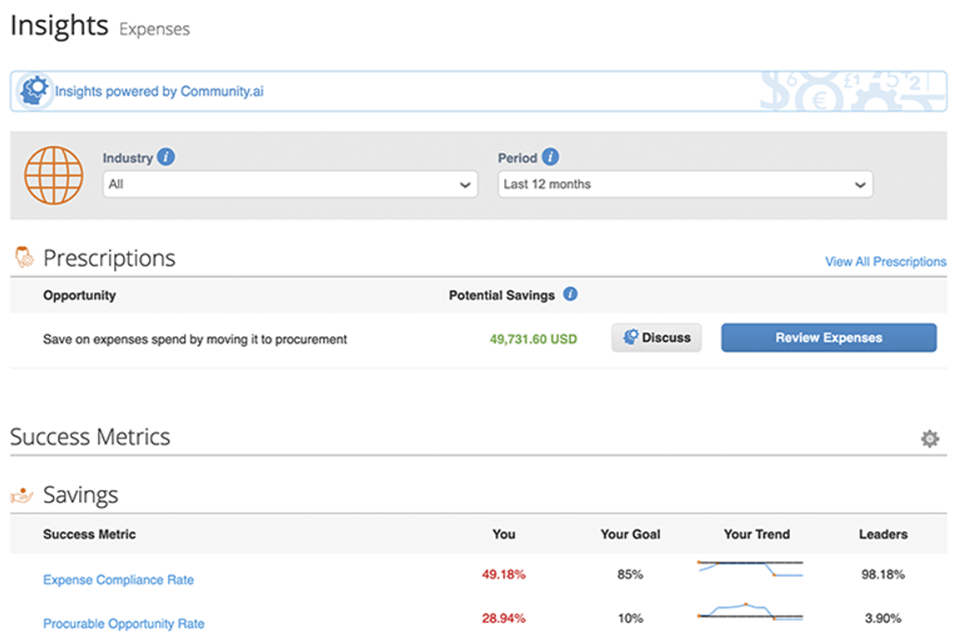

Verdict: Coupa is a cloud-based platform that hosts a variety of spend management tools. It’s primarily aimed at medium-to-large enterprises irrespective of their industry, providing them the solutions they need to enhance supply chains, increase savings, and minimize risks. This software takes advantage of anonymized client data to generate invaluable insights and suggestions on how you can optimize your financial transactions.

Coupa allows you to conveniently save expense reports and statistics to quickly transfer them to different software. Additionally, it supports integrations with ERP systems like NetSuite, SAP Business One, or Oracle Cloud Financials.

A subscription to this platform costs $549 a year for the regular service package, and $1499 per year for premium support.

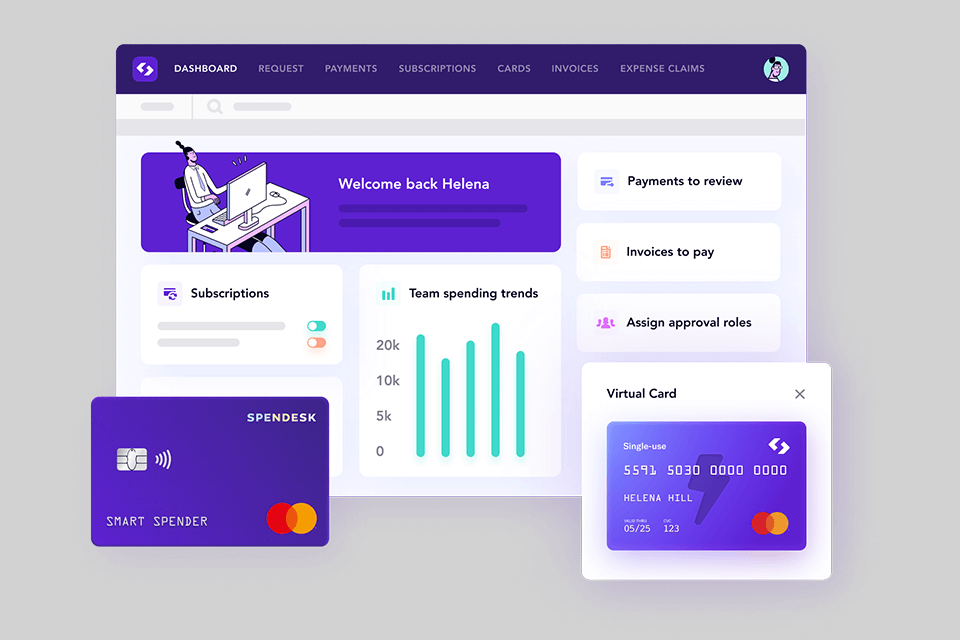

Verdict: Spendesk provides corporate cards, invoice payments, expenditure reimbursements, budgeting and approval tools, reports, and pre-accounting functionality. Additionally, it offers various useful integrations and Optical Character Recognition (OCR).

This universal tool lets you create debit cards for specific spending needs for individual staff members. Moreover, you can create digital cards for single-time purposes. Spendesk also provides push alerts for payment confirmations, accounting platform integration, a calendar-based expense overview, and a user-friendly expenditure management dashboard.

The price for using this platform directly depends on what features you need and the size of your company. Spendesk offers free demo access to help you get acquainted with all of the available features so that you can make an informed decision.

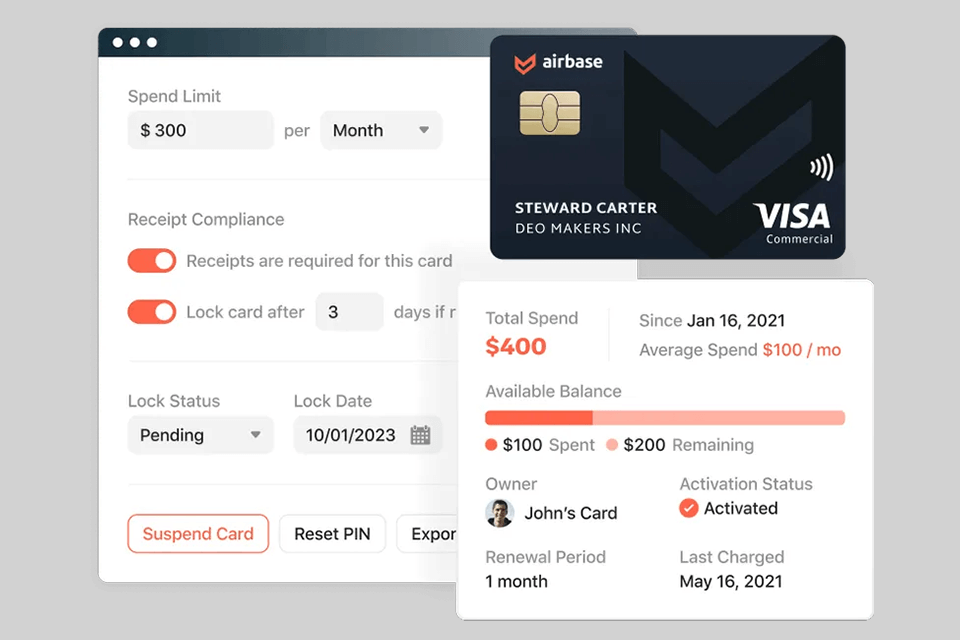

Verdict: Airbase is among the best spend management software for companies involved in different industries with a staff of between 150 to 5,000 members. It provides an array of cutting-edge features for managing expenditures, handling audits, and overseeing financial processes, while also offering the functionality usually included in payroll software.

This platform is equipped with a Security and Fraud Detection feature that facilitates card control, limits, and blocking, as well as fraud prevention, alerts, encrypted card information transfers, and much more.

The platform offers 3 subscription options, depending on the number of people in your team, but the prices aren’t openly disclosed on the website.

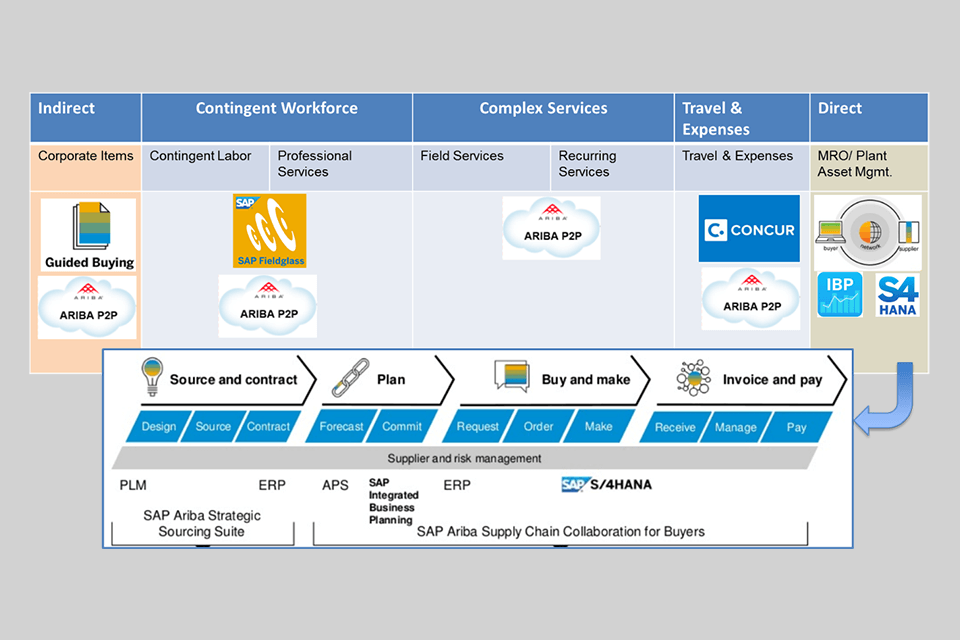

Verdict: SAP Ariba is a cloud-hosted solution developed for reinforcing procurement, expense management, and supply chain monitoring for clients and suppliers all around the world. This tool can be integrated with other SAP software to cut down the number of budgetary and operational disruptions.

You can navigate SAP Ariba’s intuitive UI within your browser while collaborating with your trade partners and leveraging industry-grade SaaS tools for managing expenses, sales, and other financial metrics – all within a single virtual space.

The company doesn’t disclose its pricing publicly, which is why you have to reach out to its client support team to learn more about the offered features and their prices.

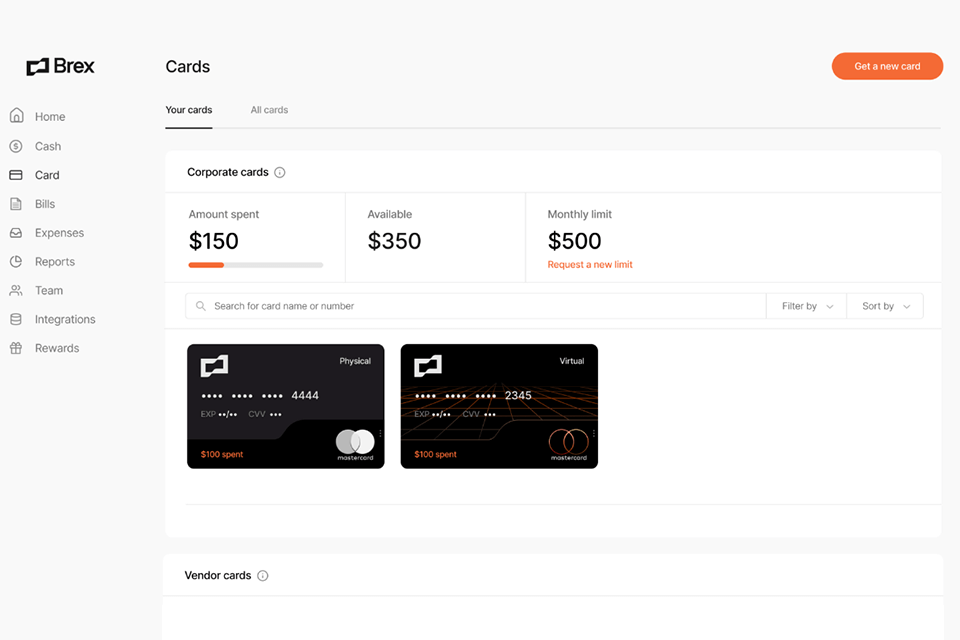

Verdict: This enterprise spend management software focuses on streamlining financial operations while adhering to your established corporate policies. Brex provides a variety of expense management tools including credit cards, business accounts, expenditure monitoring, and integration with most popular accounting software, etc.

Moreover, this platform allows you to create cards in various currencies, manage multicurrency expenses, generate expenditure reports, handle global travel arrangements, and automate the accounts payable workflow from invoicing to reconciliation

As for the pricing, the company doesn’t disclose such information publicly. The price is calculated individually depending on the type and quantity of required features.