To avoid getting targeted by cyber-criminals, it's important to understand how to protect yourself from data breaches without someone’s help when giving out your personal or money-related details online.

We often share personal info with businesses for various reasons, like paying for food delivery, checking into hotels, or getting rewards at cafes. And, of course, we use our credit and debit cards, sometimes with online accounts that keep track of what we buy.

Depending on the breach and what info you've shared, stolen data could include stuff like:

This could lead to hackers using your cards illegally, taking money from your bank, filing taxes or medical expenses using your name, or even pretending to be someone else completely.

Data is valuable because it can open a lot of aspects of someone's life, each with its own monetary value. That's why big data breaches often make headlines. Here are some examples:

In order to protect yourself from the criminal actions of cyber fraudsters, choose a reliable privacy management software, which contains all the needed features to detect and prevent data theft.

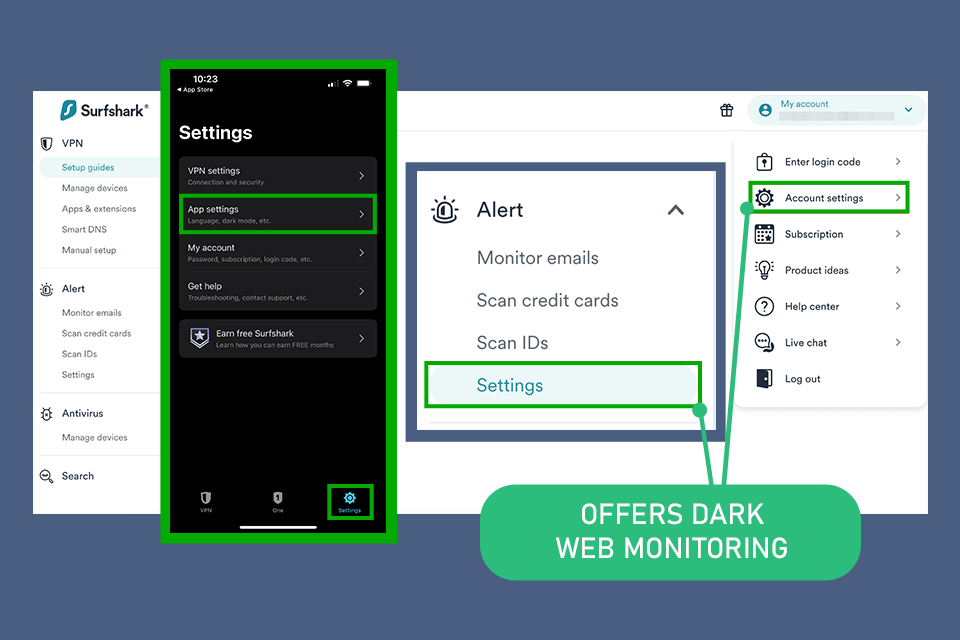

Surfshark Alert is a part of Surfshark One, which checks the internet for stolen user data and lets users know if their personal information has been in a data breach. Surfshark Alert helps me protect my online accounts by getting instant alerts and quickly securing all my data.

Surfshark Alert is a part of Surfshark One, which checks the internet for stolen user data and lets users know if their personal information has been in a data breach. Surfshark Alert helps me protect my online accounts by getting instant alerts and quickly securing all my data.

When it becomes clear that a bank or your favorite coffee shop's database has been compromised, there are several steps you can take to help protect your personal information from unauthorized use.

Make sure your passwords are strong and different. Lots of users have the same password or slight changes of it for all their accounts. So, make sure to mix up your passwords to be sure that hackers won't be able to get into all your accounts if they figure out one password.

Pro Tip. Having a strong password is crucial to protect yourself from data breaches. Here are some tips to make a strong password:

|

Length |

Make sure your password is really long, preferably with at least 12 characters. The longer your password is, the tougher it becomes for others to guess it. |

|

Complexity |

Mix up uppercase and lowercase letters, numbers, and special characters (", @, $, %, etc.). Avoid using easy words or phrases. |

|

Avoid personal information |

Don't use things like your name, birthday, or common words that are easy to guess. |

|

Unique |

Use different passwords for each of your accounts. If you use the same one for everything and it gets found out, all your accounts are at risk. |

|

Passphrase |

Think about using a passphrase instead of a password. A passphrase is a bunch of random words put together. For example, "redElephant$Jumping#OverRainbow." |

|

Avoid dictionary words |

Do not use simple dictionary words, as these are easier for attackers to guess using dictionary-based attacks. |

|

Regular updates |

Change your passwords regularly, ideally every few months, to reduce the risk of being hacked. |

Surfshark One offers a password manager as part of its collection of security tools. What I really like about Surfshark One's password manager is that it makes it easy for me to automatically fill in my login details, sync passwords on all devices, and make sure my online accounts are protected. In addition, I try to change passwords regularly, and thanks to this program, I do not have to keep them in my head.

If you think your data could be at risk, put a fraud alert on your credit, which means that any new or recent requests will be checked carefully. You can also get extra copies of your credit report to look for anything suspicious.

You can put a fraud alert with one of the three main credit reporting agencies (Equifax, Experian, TransUnion), and they'll tell the other two. A fraud alert usually lasts for a year, but you can extend it if you want to.

Putting a freeze on your credit makes it hard for hackers to take out loans or open new accounts using your name because it stops all requests to check your credit — even the ones that are legitimate. This is a stronger action than just putting a fraud alert.

However, if you plan to get a loan or a new credit card, you'll have to take some extra steps to make that happen while your credit is frozen.

Unlike the fraud alert, you'll have to contact each of the main credit agencies to freeze your credit. It can be frozen for as long as you'd like. To unfreeze your credit, you'll need to contact the agencies.

Some services can help you manage this process. They can freeze your credit, which stops companies from checking it, and that stops the whole application process for loans, credit cards, new bank accounts, and so on. Security freeze won't mess up your credit score.

You can take this step anytime, to prevent data breaches. Data broker companies gather and sell lots of info on millions of people worldwide, making a ton of money every year.

They'll sell this info to anyone, from advertisers that will use it for spam emails and phone calls, to identity thieves that will try to take some loans in your name or just steal the money off your bank account.

There is something that can be done about this though. You can contact the services that check data broker sites to see if they're selling your info. They'll also tell you how to remove your info from those sites or even do it for you.

Online protection software such as Surfshark has tools and services listed above, along with further features that can protect you online.

I also needed a reliable and fast VPN service to keep my online activities more private and protect them from thieves who want to steal credit card and account information.

After assessing the web browsing protection functions, I received a warning about sketchy websites and malicious downloads, which could potentially pose a threat to my data. Overall, it offers complete protection for your devices, privacy, and identity. And in today's world of data breaches, this kind of protection is vital.

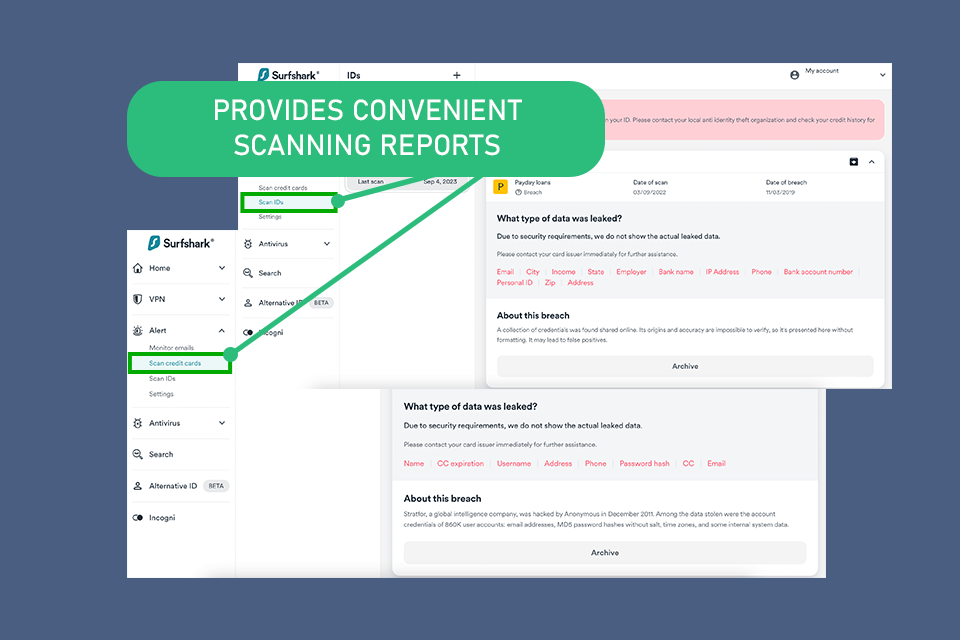

To protect yourself from the theft of personal data, you should organize total control over all resources that can be used to leak information. Surfshark One can help with this as the software checks underground forums, marketplaces, and hidden parts of the internet where stolen data is often bought and sold. By checking the dark web, it can find if users' info might be in danger.

Without this feature, it would be difficult for me to check all possible threats, and the program did it in just a few minutes and presented a report in a very convenient way.

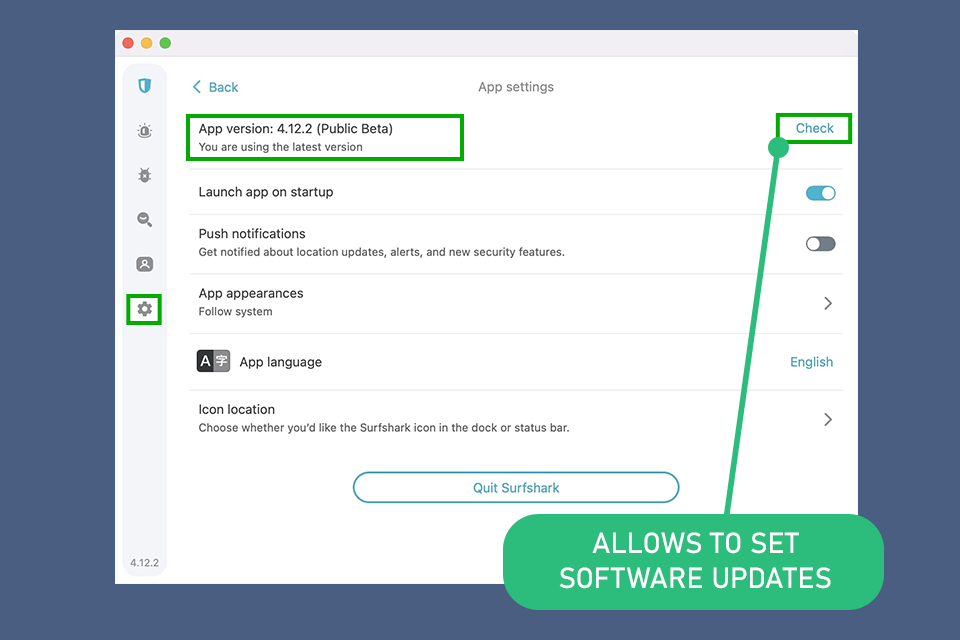

Consider regularly updating the software on your devices like your phone, tablet, and router, including antivirus software. The newest versions often have security fixes that help stop cyberattacks and potential data.

Pro Tip. Choose automatic updates and scheduling options. I often forget to update software, so having Surfshark One automatically update is helpful.

Thus, the software stays up to date with the newest security and bug fixes, which helps the software run its best and keeps it safe from threats. Plus, you don't have to remember when to update it all the time.

Of course, getting hold of details like names, email addresses, and passwords might not seem as bad as someone getting your Social Security number. But any time there's a data breach, it can put you in danger of identity theft if the hackers decide to use that info against you.

Yes, you can prevent data breaches by using the tips above, like having strong passwords and using tools such as firewalls and anti-virus software to protect against attacks.

Sometimes, companies or websites will tell their customers if there's been a data breach, but you might hear about it from somewhere else. But often, users don't find out at all. If a breach happens on a site you use, you should change your login details. Also, it's best not to use the same password for different sites and accounts.

If your financial information, such as credit card numbers or bank details, gets leaked, you should contact the bank or organization right away. They can cancel your cards and help you deal with any fraudulent charges.

Based on the Cost of a Data Breach 2022 report, it takes organizations about 277 days on average to find and stop a data breach while it's happening.