Unfortunately, Google, Microsoft, and Yahoo do not enter the list of the most reliable and secure email providers for a small business. They do not offer end-to-end encryption and do not take security issues seriously.

Chiranjeevi Charles, SEO Analyst at Pinite Info Solutions PVT LTD, says that the Google platform defines what is written in the email to identify its message. When scanning the letter, the system analyzes text for keywords to use them further as ads.

If you want to be certain that your messages are properly encrypted, so no hackers can access the content of your correspondence, you should rely only on safe email tools, which I listed in this article. Read it to discover the most effective ways to protect your business through secure email.

To get a new account and email address, you just need to specify the details of your new identity. It is easy to do this task with Alternative ID – a highly functional tool from Surfshark. It is included in the Surfshark ONE bundle.

This is one of the most reliable ways to prevent theft of sensitive data like email, phone numbers, etc. The most considerable benefits of this tool are a no-logs policy and robust AES-256 encryption that makes unauthorized access to your data simply impossible.

One of the tasks of Alternative ID is to create a kind of backup email to keep your actual email address well protected. In such a way, my inbox is always free from spam & annoying marketing subscriptions. I also appreciate that the app immediately notifies me whenever someone gets access to my email address, credit card data, personal IDs, or other sensitive data.

To take advantage of this product, you need to install a VPN and purchase a subscription. Fortunately, the product is compatible with all desktop and mobile devices, making it a perfect solution for everyone who is always on the go. Another considerable advantage is that Alternative ID can serve as many connections simultaneously as required, so you’ll not have trouble using the tool on various devices at the same time.

The Alternative ID is available as a part of Surfshark ONE Suite, which is priced at €3/mo. It provides access to a VPN, an Ad blocker, a Cookie pop-up blocker, a Private search engine, and so on.

The Alternative ID is available as a part of Surfshark ONE Suite, which is priced at €3/mo. It provides access to a VPN, an Ad blocker, a Cookie pop-up blocker, a Private search engine, and so on.

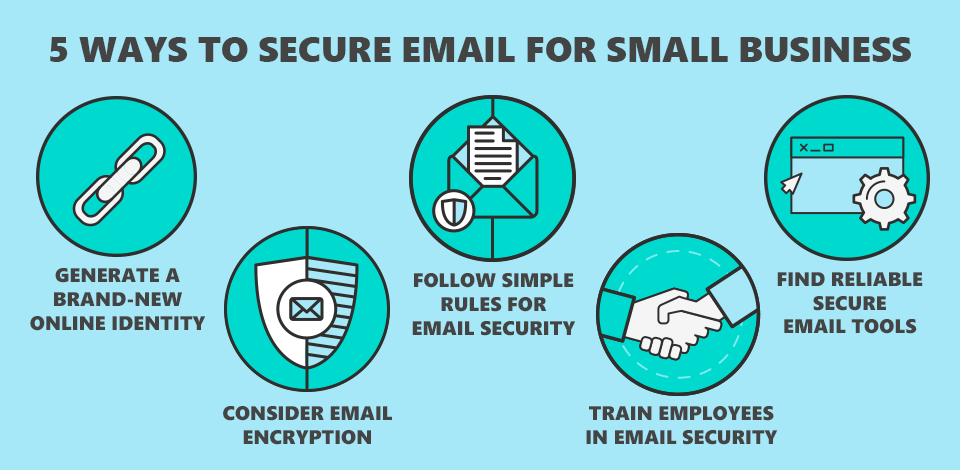

By encrypting emails, you can prevent hackers from accessing your personal data only allowing specific users to open and read your letters. Depending on the required level of protection and convenience, you can choose from several different methods.

For instance, one of the most effective options is to install an email certificate like PGP (Pretty Good Privacy), using which an employee can provide access to emails or other info with the help of a public key shared by the company owner.

Another simple yet effective method is to use a third-party secure email for a small business that offers encryption and provides all the necessary tools to protect your email account and emails. A considerable plus is that even email providers do not have the right to access your emails. So, your letters only become available to authorized recipients.

The providers can also use the Sender Policy Framework (SPF) to strengthen the protection of your emails. In this case, when someone tries to send a letter on your behalf from an unvalidated IP address, the receiver will get an alert that the email was sent by a non-authorized person, so they can easily reject it.

Each team member should be authorized in the email system using their own password and personal computer. These passwords should be renewed every three months. When an employee changes a password, he should consider turning on multifactor authentication.

Besides, it is important to avoid using identical passwords for several accounts or websites. Allow the use of a password manager or a single sign-on function for more convenience. By the way, CommonKey and LastPass are some of the most efficient tools for small businesses to store codes, bank accounts, email accounts, PIN numbers, and other account data in one place.

Moreover, there are services like PwnedList that can help you define the compromised passwords and notify you if any of your email addresses become vulnerable because of password leakage.

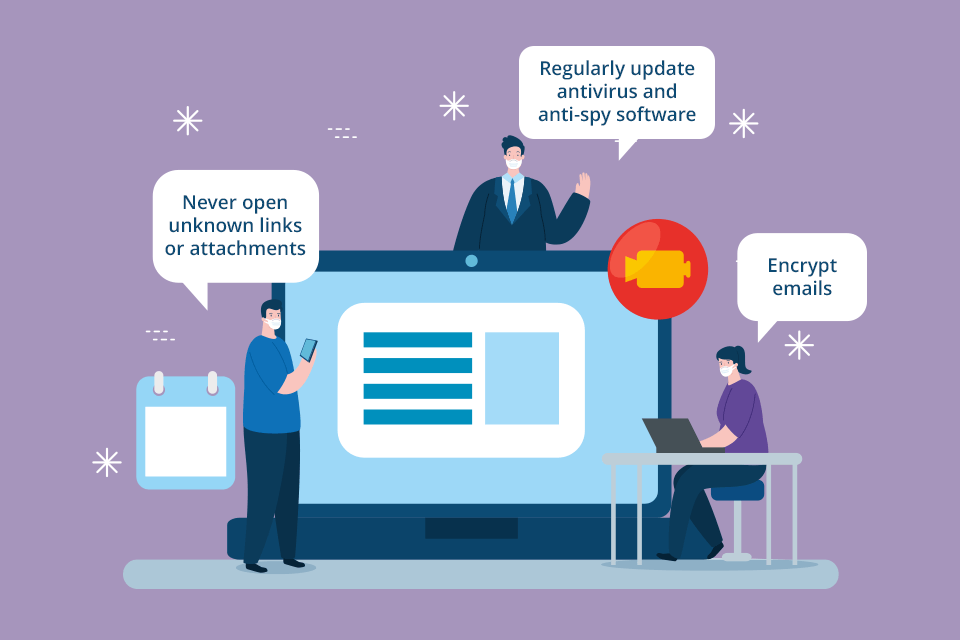

There is a list of rules the employees should know and comply with to maintain a high level of security:

If an employee uses a personal mobile device, he should also take care of security by encrypting data, protecting the device with passwords, and installing reliable security applications like Bitdefender or Norton.

To ensure email security, small businesses leverage programs that test workers with phishing campaigns, spear-phishing emails, and other cybersecurity threats. If the employees pass these tests, they get some kind of reward.

Price: Free or from $5/month for 1 user

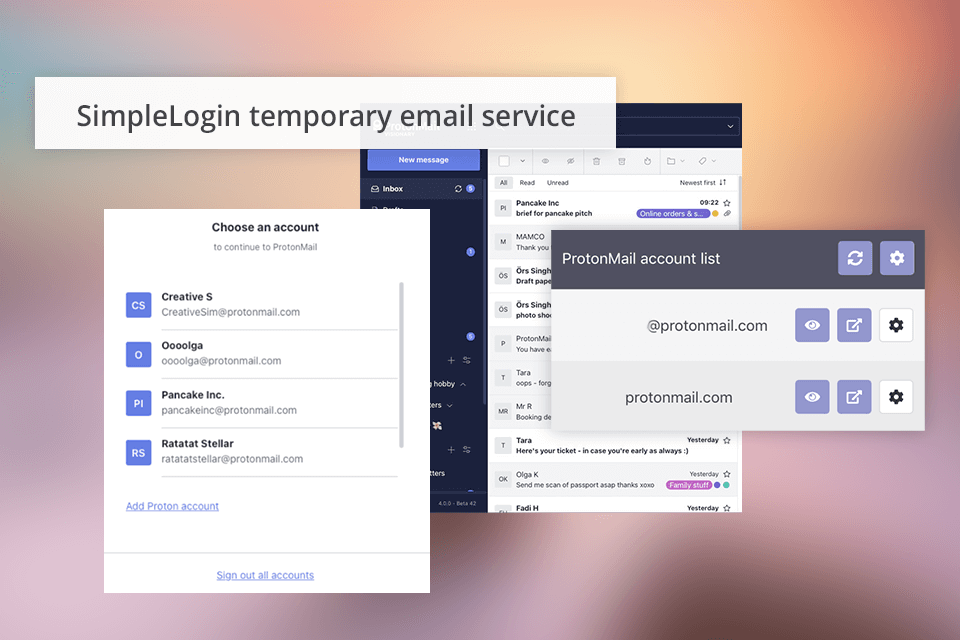

This is a secure email service for small businesses with the main office in Switzerland. It appeals to clients with reliable end-to-end asymmetric encryption. ProtonMail is available for free, as long as you send fewer than 150 messages per day. Besides, a free version has limited storage.

Self-destructing emails are the highlight of this service. Thanks to it, you can define when a specific letter is to be removed from the recipient’s inbox.

Zero-access encryption, which means that even PhotonMail cannot decrypt your messages, is another positive feature.

Price: Free or from $45/mo

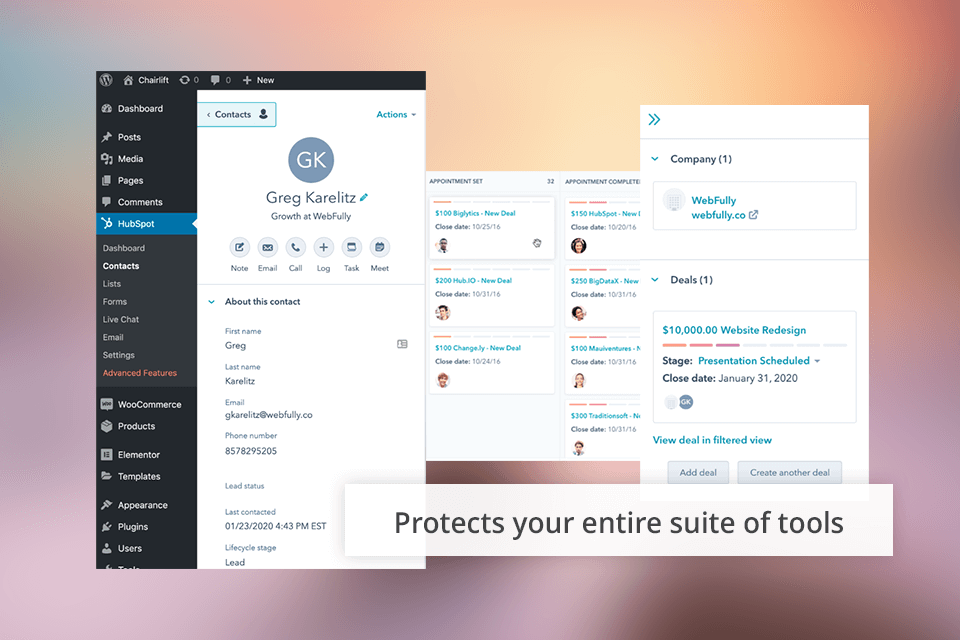

HubSpot surpasses other email security tools by delivering multiple security options to keep your and your client’s data in absolute safety.

Its email marketing tool uses SPF, DKIM, DMARC, and the latest BIMI authentication standards to check the correspondence. It is great that HubSpot encrypts all the personal data before transmitting or storing it. The service also applies all the needed security measures to ensure that only authorized users can enter their network.

Price: Free trial or from $6/mo

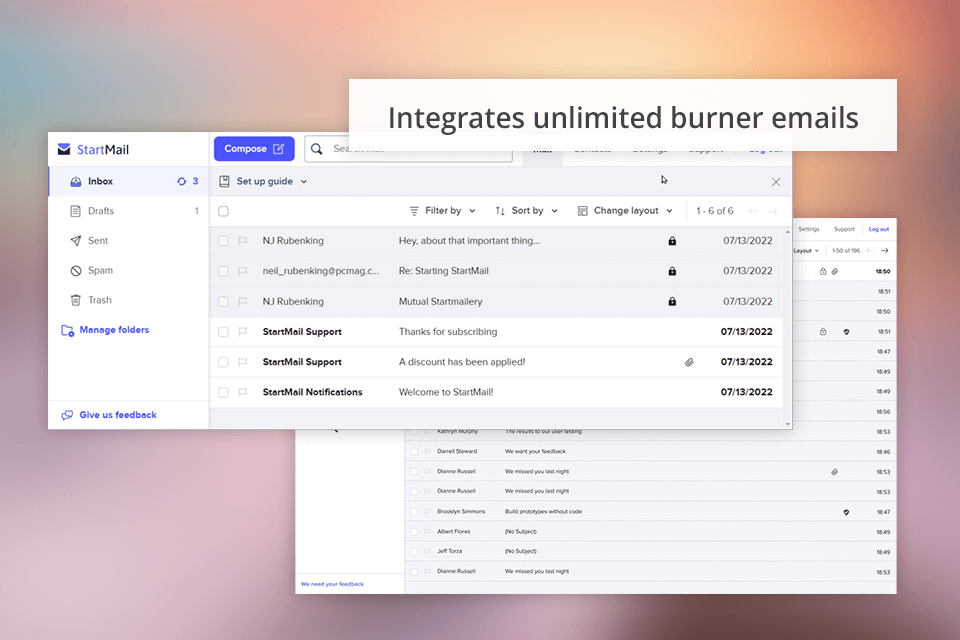

Startmail protects your emails with end-to-end encryption via IMAP and OpenPGP, so safe communication is guaranteed. Another advantage of this service is two-factor authentication, which means that no one can read messages even if your password is revealed.

Another considerable plus is that the service integrates unlimited burner emails into its mode of operation. Besides, it is possible to add additional custom aliases, which will come in handy when authorizing on some platforms where you need to provide a quick throwaway address. This solution is ideal for those who need to create an email for selling things on Craiglist.

Price: Free or from €3/mo

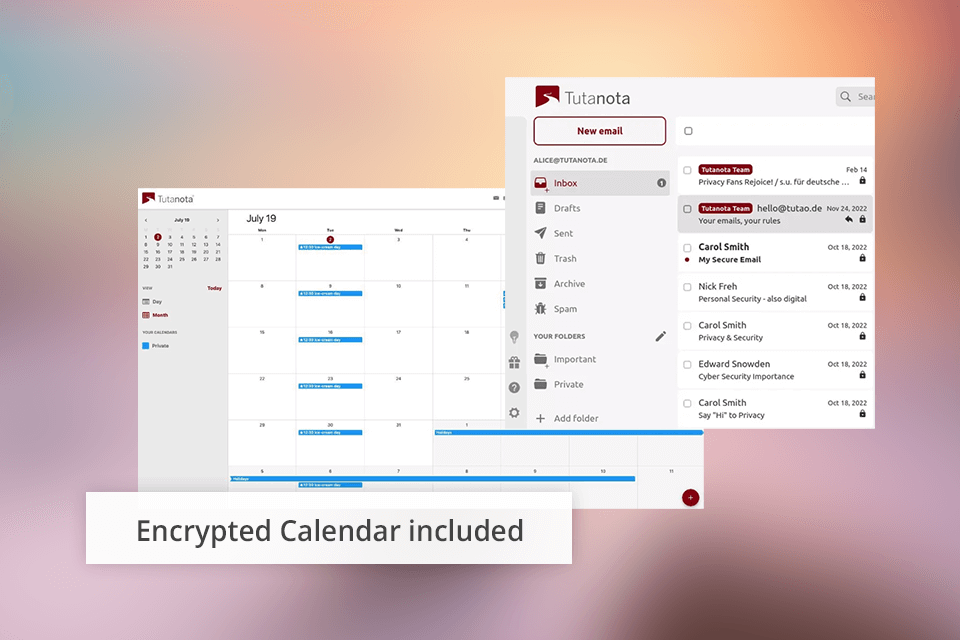

End-to-end encryption and two-factor authentication make Tutanota one of the most secure email providers for small businesses. It further boosts the safety of your email by encrypting the names of the sender and recipient, as well as the theme of the letter.

Removing IP addresses and emails from the heading metadata, Tutanota protects your privacy and makes communication more secure. Another selling point of the service is a strict no-log policy. However, not all users trust this provider because of the fact that Germany is in the Fourteen Eyes intelligence alliance.

Image blocking, header stripping, and alerts about phishing attacks are among other features that ensure users’ security. I was pleasantly surprised that there are no ads and the applications, including the encrypted Calendar, are extremely user-friendly. The ability to synchronize between them is another considerable plus.

Price: From €1/mo

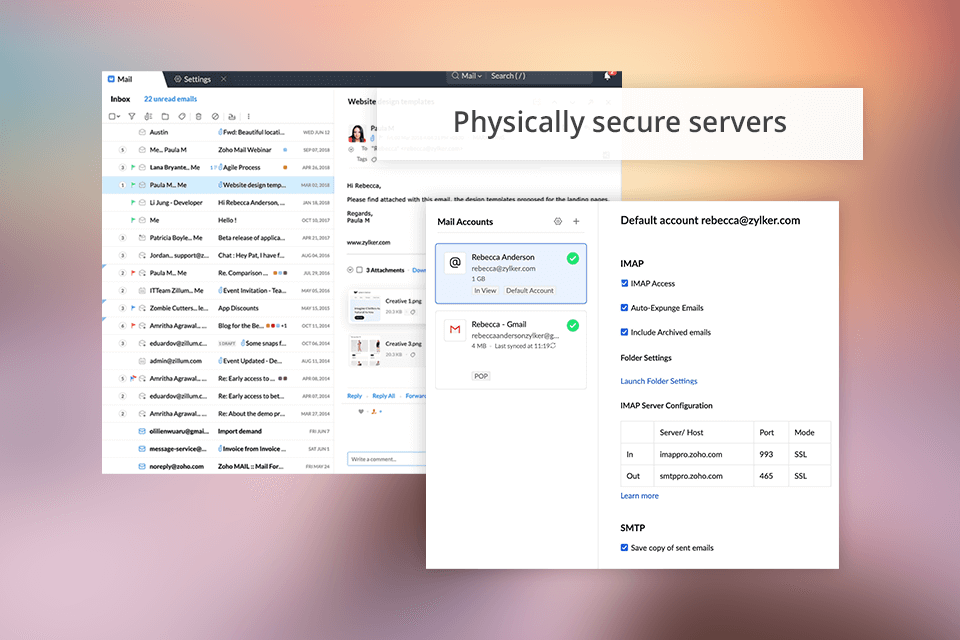

Zoho Mail is one of the secure email solutions for a small business that uses S/MIME asymmetric cryptography to encrypt your emails in transit and on the Zoho servers. Besides, each user has a unique electronic signature, which provides the highest level of protection. The service also offers malware & spam protection, and end-to-end encryption.

Zoho Mail is available either as a web or mobile application and attracts users with its intuitive performance. It is easy to manage all the inboxes and their settings from a single spot. The service boasts an attractive and intuitive design, which is especially important for those who are going to use this provider daily.

Generally, after changing the email service, you need to generate a new email address. If you need your old email account, you can forward all the letters from it to your new inbox. But pay attention to the fact that such emails are delivered by the old provider’s servers, so they are not end-to-end encrypted.

End-to-end encryption is the highlight of the best secure email for a small business. It ensures that the email provider and third-party service do not have access to your letters. Only the recipient can open and read the content of your email. In contrast, such popular email services like Google can read letters (by defining the keywords), making them vulnerable to hackers. PGP and S/MIME are two common standards used for encryption. PGP offers both symmetric and asymmetric encryption while S/MIME uses certificates to be signed either by a local or public certificate authority. Such a certificate is proof that you, not someone else, sent the letter.

It provides robust protection of your electronic correspondence by concealing your metadata and keeping messages in a privacy-friendly location. Besides, you can use a DMARC record generator by EasyDMARC to ensure that your emails are authenticated and protected against phishing and spoofing attempts, further enhancing the security and reliability of your communication.

A hacker will pretend to be you and send the letters on your behalf. The content of such letters can be compromised and even contain requests to transfer money. Besides, your online identity and the security of other accounts also depend on the level of protection of your inbox.

There are no obvious signs that the content of your emails became available to unintended users. For example, the police may be interested in your communication and ask the provider to provide access to it. If this happens, you’ll never know that someone else monitors your messages. So, the only way to protect your emails is to use end-to-end encryption. Adjusting it without deep knowledge may be challenging, so it is better to hire professionals for the task. NeoSpace service can be very helpful in this case.